Investing has traditionally been seen as a game for the wealthy or financially savvy, requiring significant capital and in-depth knowledge of markets. However, micro-investing apps are transforming this narrative, making investing accessible to everyone—even those with minimal funds. These platforms leverage technology to help individuals grow their wealth incrementally, often using spare change from everyday transactions.

What is Micro-Investing?

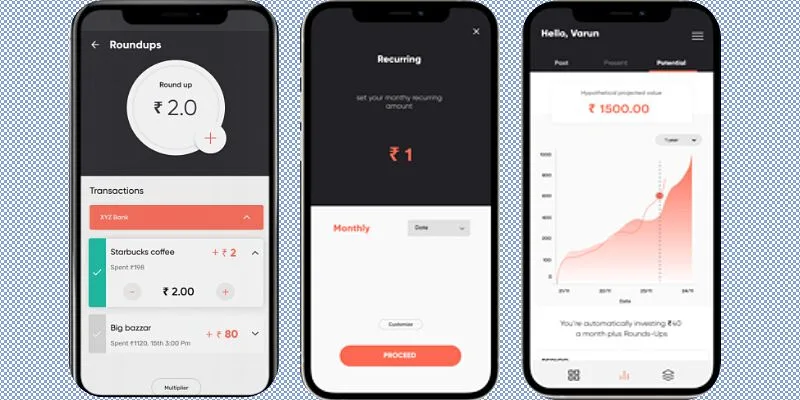

Micro-investing allows users to invest small amounts of money, often just a few cents at a time. Instead of requiring large initial investments, these apps enable users to round up their purchases to the nearest dollar and invest the difference. For example, if you buy a coffee for $3.75, the app rounds up to $4.00 and invests the $0.25 in your portfolio.

Popular micro-investing platforms such as Acorns, Stash, and Robinhood have democratized investing by offering user-friendly interfaces, educational tools, and low-cost entry points. These apps have enabled people to build wealth with as little as a few dollars, removing barriers like high fees and complex account setup processes.

How Micro-Investing Works

Micro-investing apps typically follow these steps:

- Linking Accounts: Users connect their bank accounts or credit cards to the app.

- Rounding Up Transactions: The app automatically calculates the spare change from transactions and sets it aside for investment.

- Automated Investing: The spare change is invested in diversified portfolios of exchange-traded funds (ETFs) or other low-risk assets.

- Customization: Many apps allow users to choose investment themes, such as sustainable investing or technology-focused portfolios.

Benefits of Micro-Investing

- Low Barrier to Entry: Micro-investing eliminates the need for substantial upfront capital, allowing anyone to start building wealth.

- Automation: The process is hands-free ideal for busy individuals or those new to investing.

- Compound Growth: Small, regular contributions can grow significantly over time, thanks to the power of compound interest.

- Financial Literacy: Many apps offer educational resources to help users understand the basics of investing and develop healthier financial habits.

Building Wealth with Spare Change

Although investing in spare change might seem insignificant, it can lead to meaningful growth over time. For example, rounding up an average of $1 per day and investing it could result in substantial savings after a decade, especially when factoring in potential returns.

Micro-investing apps also encourage consistent saving habits. Users develop a disciplined approach to investing by automating contributions without requiring active decision-making.

Challenges to Consider

While micro-investing is a fantastic entry point, it’s not without limitations. The returns on small investments may take years to accumulate, and some apps charge fees that could diminish profits for those investing minimal amounts. Additionally, micro-investing alone may not suffice for long-term financial goals like retirement or significant life expenses.

The Future of Micro-Investing

Micro-investing apps are poised to significantly contribute to closing the wealth gap. As technology advances, these platforms will likely integrate with other financial tools, offering more personalized and sophisticated investment options. Moreover, gamification and social features could further engage users and promote financial literacy.

Conclusion

Micro-investing apps have revolutionized the way people approach wealth building. By turning spare change into a powerful investment tool, these platforms make it easy for anyone to take the first step toward financial independence. While small contributions might not seem impactful initially, their cumulative effect and the power of compounding can create substantial wealth over time.