Artificial Intelligence (AI) is transforming industries worldwide, and the financial sector is no exception. AI has ushered in a new era of data-driven decision-making in investment strategies, enabling investors to analyze vast amounts of data, identify patterns, and make informed decisions with unprecedented accuracy. This technological revolution is reshaping how portfolios are managed and unlocking new opportunities for institutional and individual investors.

Understanding AI in Investment Strategies

AI in investment strategies involves using algorithms, machine learning, and advanced analytics to optimize portfolio performance. Unlike traditional methods, which rely heavily on human expertise and historical data, AI can process and analyze real-time information from diverse sources, including news articles, social media, and market trends.

For example, AI-driven platforms use natural language processing (NLP) to analyze sentiment in news reports and social media posts, identifying potential market shifts before they occur. Machine learning models can predict stock movements by studying historical trends and market conditions, offering recommendations tailored to specific investment goals.

Benefits of AI-Driven Investment

- Enhanced Decision-Making: AI algorithms can process and interpret vast amounts of data much faster and more accurately than humans. This enables investors to make well-informed decisions based on comprehensive insights.

- Risk Management: By analyzing historical data and current market trends, AI can identify potential risks and suggest strategies to mitigate them, ensuring portfolio resilience.

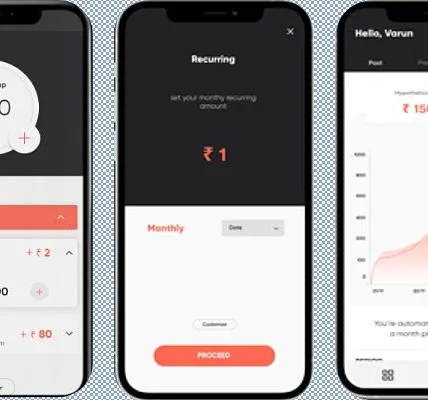

- Personalization: AI-powered robo-advisors offer personalized investment advice based on individual preferences, risk tolerance, and financial goals, making professional-grade tools accessible to everyday investors.

- Cost Efficiency: AI automates many labor-intensive processes, reducing the cost of portfolio management and enabling investors to focus on strategy rather than administrative tasks.

Use Cases in the Financial World

AI is revolutionizing various aspects of investment, such as:

- Algorithmic Trading: AI-powered trading systems execute trades at optimal times based on real-time data analysis, maximizing profits and minimizing losses.

- Portfolio Optimization: Machine learning models analyze an investor’s portfolio and suggest adjustments to enhance performance while minimizing risk.

- Fraud Detection: AI identifies unusual transactions and suspicious activities, safeguarding investments from fraud and cyber threats.

- Market Prediction: Predictive analytics help forecast market movements, offering a competitive edge in timing investments.

Challenges and Ethical Considerations

Despite its advantages, AI has challenges in investment strategies. One primary concern is the potential for algorithmic bias, where flawed data sets lead to skewed predictions. Additionally, reliance on AI can lead to over-optimization, where strategies perform well in backtesting but fail in real-world scenarios.

Another critical concern is the ethical implications of AI-driven decisions. Automated systems might prioritize profits over socially responsible investing, conflicting with the growing demand for ESG-compliant portfolios.

The Future of AI in Investing

As technology evolves, AI is expected to become an even more integral part of investment strategies. Innovations like quantum computing could enhance AI’s predictive capabilities, making portfolio management more precise. Moreover, as financial institutions adopt blockchain technology, AI will likely play a crucial role in improving transparency and trust in the investment process.

Conclusion

AI is undeniably a game changer in the world of investing. Combining speed, accuracy, and adaptability has transformed how portfolios are managed, making sophisticated tools accessible to investors at all levels. While challenges remain, the continued integration of AI in financial strategies offers exciting prospects for anyone looking to optimize their investments and navigate an increasingly complex market landscape.